Smarter Investing Starts Here

At Portfoly.Net, we don’t just report the markets — we help you grow in them. Our expert-driven stock portfolio management services are built to deliver consistent, data-backed results for investors at every level.

Personalized Portfolio Management

We create tailored stock portfolios based on your financial goals, risk appetite, and market conditions. Our hands-on strategy combines technical analysis with smart diversification to ensure you’re positioned for long-term success.

Real-Time Market Monitoring

We don’t just set and forget. Our team constantly monitors market activity and your portfolio performance to make timely adjustments — helping you stay ahead of the curve in a volatile market.

Risk Management & Optimization

We apply industry-standard risk management frameworks to preserve capital and optimize gains. From sector exposure limits to stop-loss triggers, your portfolio stays agile without unnecessary risk.

Monthly Performance Reports

Get detailed, transparent reports that break down your portfolio’s performance, stock movements, and our strategic decisions — so you’re never in the dark about your investments.

Retirement Portfolio Planning

We help you create a retirement investment strategy that balances risk and stability, tailored to your age, timeline, and income goals. Whether you’re 10 years away or retiring soon, we structure your investments for long-term security.

Income Generation for Retirees

Already retired? We’ll optimize your portfolio for income generation using dividend-paying stocks, bonds, and low-volatility assets. Our goal is to provide reliable income while preserving your capital.

FAQs

What is your investment experience?

We have been investing in the stock market for the last 10 years.

What is your trading behavior?

We won’t build your portfolio by short term trading or day trading. We always believe in long term trading.

How do you manage risk in portfolio?

Actually, we are active managers. So, we’ll diversify your portfolio by investing in different stocks to minimize your overall risk.

Which stock brokers do you require?

We require the highly regulated brokers based on your choice. We prefer Interactive Brokers most.

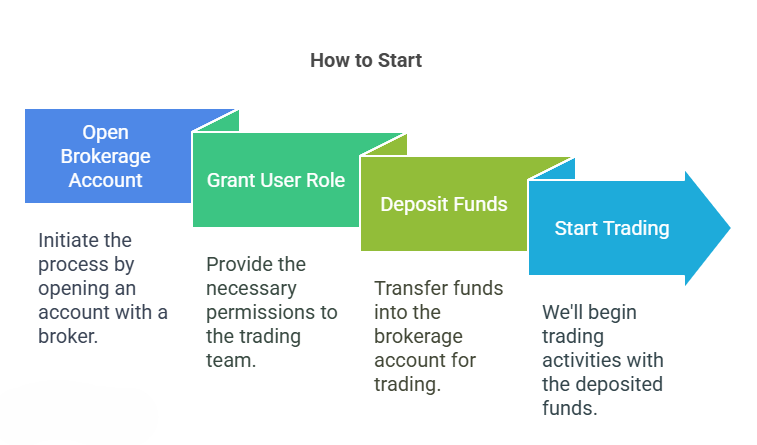

How will I give you access in my brokerage account?

You’ll create a trader role with only the trading permission from your brokerage account. Then you’ll create a user for us following that trader role. Thus, we’ll get access to your brokerage account. You can follow the link as a reference: https://www.youtube.com/watch?v=C-ND1eURgok

Is there a minimum investment required to get started?

Yes, the minimum investment amount for our portfolio management service is $10,000. You’ll deposit in your brokerage account.

How is the monthly fee charged?

Fees are charged at the end of each month, based on your current portfolio balance.

| Investment Range (USD) | Monthly Management Fee |

|---|---|

| $10,000 – $100,000 | 0.10% of capital * |

| $100,001 – $500,000 | 0.09% of capital |

| $500,001 – $1,000,000 | 0.08% of capital |

| Over $1,000,000 | 0.07% of capital |

* Minimum monthly management fee is $30.

Is there any hidden fees?

No hidden fees. We grow when you grow.

Can I withdraw funds anytime?

Absolutely. Your funds remain in your brokerage account under your control. We’ll manage your portfolio with only the trading permission, we’ll decide which trades need to be closed to make available your withdrawal money.

Which stock markets do you support?

We support all the major stock markets in the world including New York Stock Exchange (NYSE), NASDAQ, Shanghai Stock Exchange (SSE), Euronext, Tokyo Stock Exchange, Hong Kong Stock Exchange (HKEX), Shenzhen Stock Exchange (SZSE), London Stock Exchange (LSE Group), National Stock Exchange of India (NSE), Saudi Stock Exchange (Tadawul) and more.