Investing in the stock market can be one of the most rewarding financial decisions you make—but it also comes with significant risks, especially without the right guidance. As we head further into 2025, market dynamics are rapidly evolving with new technologies, economic challenges, and global trends shaping the way we invest. For both seasoned investors and beginners alike, hiring a professional stock portfolio manager can offer substantial benefits.

What is a Stock Portfolio Manager?

A stock portfolio manager is a financial professional who specializes in managing investments in stocks and other securities on behalf of individuals or institutions. Their primary responsibility is to develop and execute investment strategies tailored to a client’s financial goals, risk tolerance, and time horizon. Portfolio managers continuously monitor market trends, assess risks, and adjust holdings to optimize returns. They utilize a wide range of tools, from fundamental and technical analysis to advanced financial software, to make informed investment decisions. By delegating the management of your investments to a market expert, you gain access to strategic insights, reduce emotional decision-making, and potentially achieve better financial outcomes.

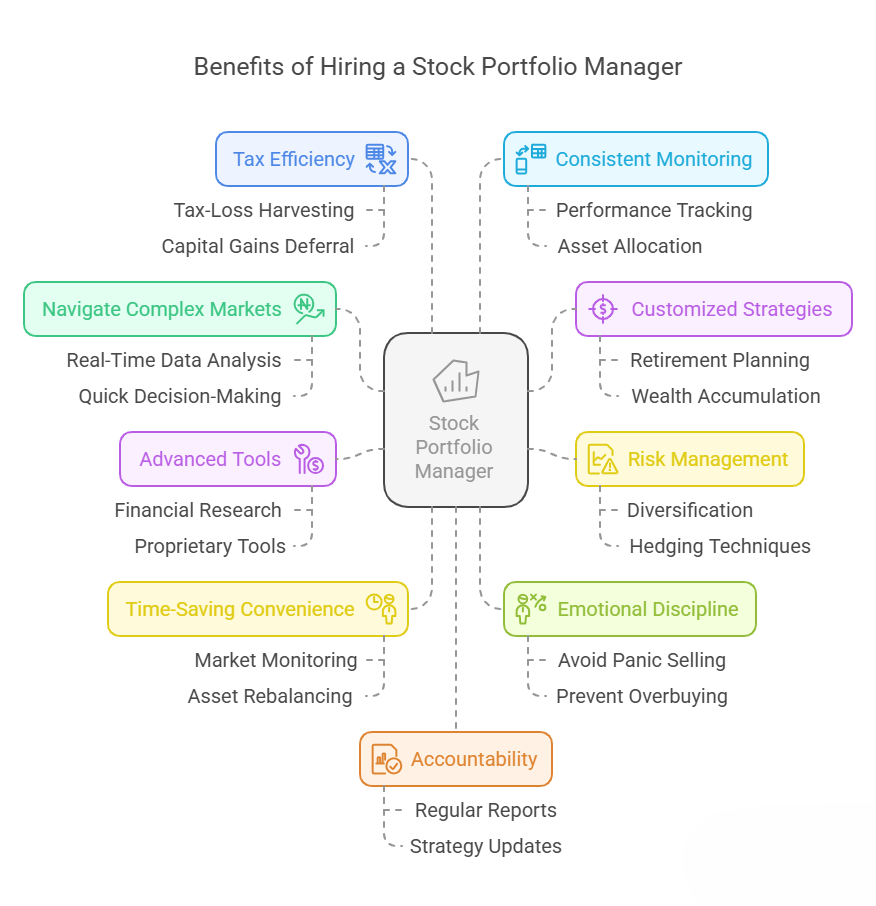

Reasons to Hire A Stock Portfolio Manager

Here are 10 powerful reasons why working with a stock portfolio manager in 2025 can help you achieve your financial goals more efficiently and effectively.

1. Navigate Complex and Volatile Markets

The stock market in 2025 is more complex than ever. With the integration of AI-driven trading, cryptocurrency influence, geopolitical tensions, and fluctuating interest rates, managing investments requires real-time data analysis and quick decision-making. A stock portfolio manager brings expertise to navigate this volatility, offering tailored strategies that protect your assets during downturns and capitalize on growth opportunities.

2. Customized Investment Strategies Based on Your Goals

Every investor has unique financial goals—retirement planning, wealth accumulation, buying a home, or funding education. A portfolio manager builds customized investment strategies that align with your risk tolerance, time horizon, and objectives. They assess your financial situation holistically and create a roadmap for long-term success.

3. Professional Risk Management

Risk is inherent in every investment, but managing it effectively is the key to long-term success. Portfolio managers are trained in risk assessment and mitigation strategies. They use diversification, asset allocation, and hedging techniques to minimize potential losses while maximizing gains.

4. Access to Advanced Analytical Tools and Research

Top portfolio managers have access to premium financial research, proprietary tools, and analytics that the average investor may not. These tools allow for deeper market insights, more accurate forecasting, and data-driven decision-making. Leveraging this advanced technology can significantly enhance portfolio performance.

5. Time-Saving Convenience

Managing your own portfolio is time-consuming. Between monitoring markets, analyzing stocks, and rebalancing assets, DIY investing can feel like a full-time job. A portfolio manager takes on this responsibility, freeing up your time while ensuring your investments are professionally handled.

6. Emotional Discipline and Objectivity

Investors often fall victim to emotional decisions—panic selling during downturns or overbuying in bull markets. A portfolio manager offers objective, emotion-free management. They stick to your strategy regardless of market noise, helping you avoid costly mistakes driven by fear or greed.

7. Tax-Efficient Investing

Tax implications can eat into your investment returns if not carefully managed. Portfolio managers understand tax-efficient strategies such as tax-loss harvesting, asset location optimization, and capital gains deferral. These techniques can enhance after-tax returns and keep your portfolio compliant with current tax laws.

8. Consistent Portfolio Monitoring and Rebalancing

Markets shift, and so should your portfolio. A stock portfolio manager continuously monitors performance and rebalances your holdings to maintain your desired asset allocation. This ensures your investment strategy remains aligned with your goals, even as conditions change.

9. Accountability and Regular Reporting

A professional manager is accountable to you. They provide regular performance reports, strategy updates, and financial reviews. This transparency allows you to track progress, understand the reasoning behind each investment, and stay informed without having to manage every detail.

10. Peace of Mind and Confidence

Ultimately, hiring a stock portfolio manager provides peace of mind. Knowing that a professional is managing your investments can reduce stress, build confidence, and help you stay focused on other important aspects of your life. You’ll sleep better knowing your money is in expert hands.

Conclusion: The Smart Move for 2025 Investors

As we navigate a transformative era in the financial world, having expert guidance has never been more important. Whether you’re looking to build wealth, protect assets, or plan for retirement, hiring a stock portfolio manager in 2025 could be the smartest investment decision you make.

With personalized strategies, risk management, access to advanced tools, and ongoing support, portfolio managers empower you to meet your financial goals confidently. In a year filled with both opportunity and uncertainty, professional portfolio management is not just a luxury—it’s a necessity.

Ready to take control of your financial future? Connect with a trusted stock portfolio manager today and start building a smarter investment strategy for 2025 and beyond.